In the vast landscape of digital finance, Bitcoin mining stands as a beacon of opportunity, drawing in investors and tech enthusiasts alike. America, with its robust infrastructure and innovative spirit, has emerged as a prime destination for those seeking to tap into the lucrative world of cryptocurrency extraction. As the demand for Bitcoin surges, so does the potential for substantial returns, making it an enticing venture for both novices and seasoned miners. The allure lies not just in the financial gains but in the technological prowess required to navigate this dynamic field.

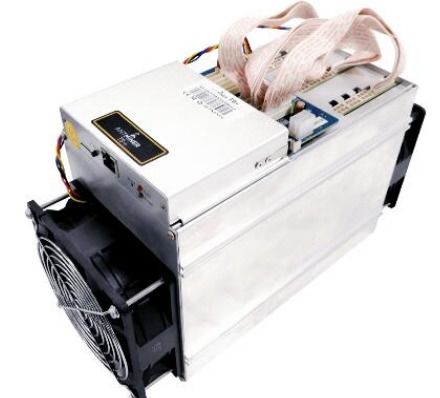

At the heart of Bitcoin mining is the process of validating transactions on the blockchain, a decentralized ledger that ensures security and transparency. In America, regions like Texas and Washington state boast abundant energy resources, which are crucial for powering the energy-intensive mining rigs. These machines, sophisticated pieces of hardware designed to solve complex mathematical puzzles, are the workhorses of the industry. Companies specializing in selling and hosting these devices offer tailored solutions that make entry into mining more accessible than ever before.

Beyond Bitcoin, the ecosystem includes other cryptocurrencies like Ethereum and Dogecoin, each with its own mining nuances. Ethereum, for instance, has transitioned towards a more energy-efficient proof-of-stake model, yet traditional mining rigs still play a role in its network. Dogecoin, born from internet culture, continues to attract miners due to its vibrant community and lower entry barriers. This diversity in cryptocurrencies allows miners to diversify their portfolios, mitigating risks associated with volatility in any single coin. Exchanges such as Coinbase and Binance facilitate the trading of these assets, turning mined coins into real-world value.

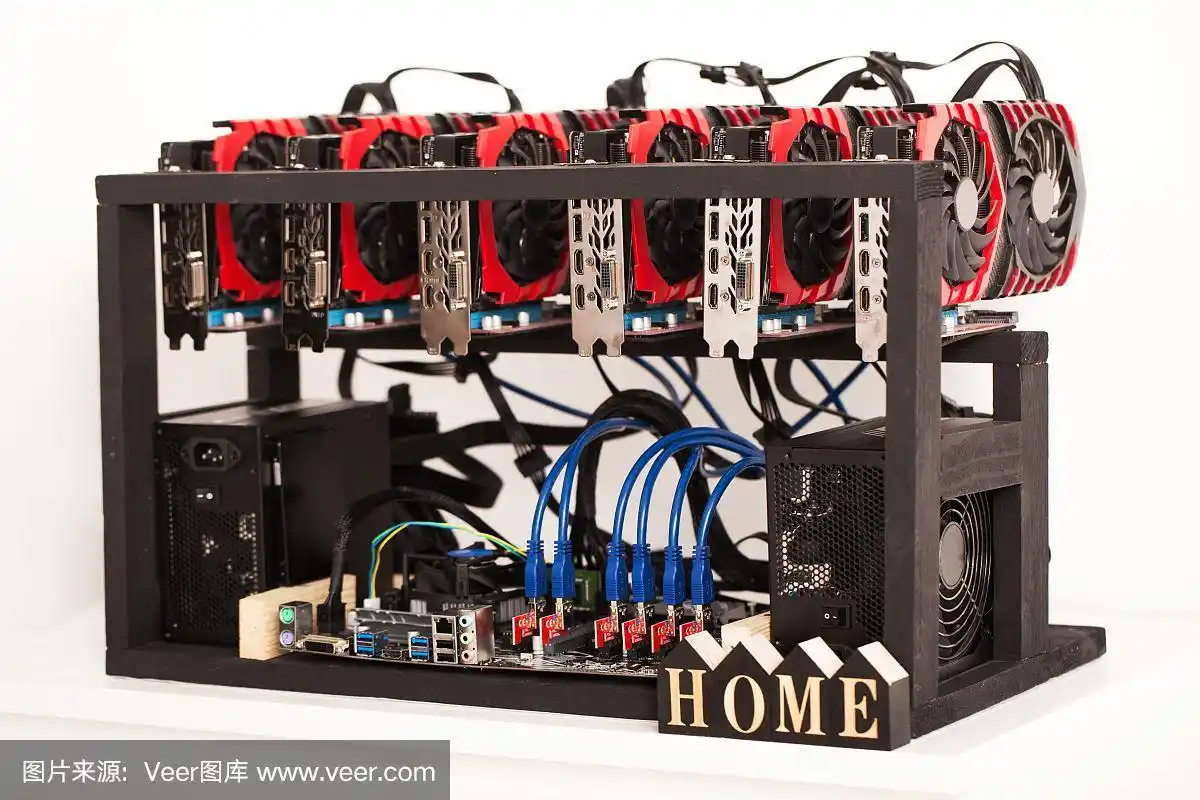

One of the key advantages of mining in America is the availability of professional hosting services. These services allow individuals to purchase mining machines without the hassle of maintaining them personally. Imagine racks of powerful miners humming in climate-controlled data centers, monitored by experts to ensure optimal performance. This setup not only reduces operational costs but also enhances efficiency, as hosts often leverage renewable energy sources to power their facilities. For those new to the scene, starting with hosted mining can be a strategic move, blending the excitement of crypto with the reliability of professional management.

As technology evolves, so do the tools of the trade. Mining farms, vast arrays of interconnected machines, have become synonymous with large-scale operations in America. These farms operate around the clock, their miners—specialized computers optimized for hashing algorithms—crunching data to earn rewards. The competition is fierce, with miners constantly upgrading to more efficient models to stay ahead. This environment fosters innovation, pushing companies to develop cutting-edge hardware that can handle the increasing difficulty of blockchain networks.

Yet, the path to success in mining is not without challenges. Fluctuations in cryptocurrency prices, regulatory hurdles, and environmental concerns about energy consumption can impact profitability. In America, however, forward-thinking policies in states like Wyoming are creating a more favorable climate for crypto businesses. By focusing on sustainable practices, such as using hydroelectric or solar power for mining rigs, operators can address these issues head-on. This balance of opportunity and responsibility makes American mining a model for global standards.

To maximize returns, it’s essential to understand the interplay between hardware, software, and market trends. For Ethereum enthusiasts, the shift to proof-of-stake means exploring staking as an alternative to traditional mining. Dogecoin miners might capitalize on community-driven events that boost its value unexpectedly. Meanwhile, Bitcoin remains the gold standard, with its halving events periodically increasing scarcity and potential rewards. By staying informed through exchanges and community forums, miners can adapt their strategies to these unpredictable shifts.

In this ever-changing arena, partnering with a company that excels in selling and hosting mining machines can be a game-changer. Such partnerships provide not only the hardware but also the expertise to navigate the complexities of crypto mining. Whether you’re setting up a personal rig or scaling up to a full mining farm, the opportunities in America are ripe for the taking. As the digital economy expands, those who seize these moments stand to reap impressive rewards, blending technology, finance, and innovation into a profitable symphony.

Ultimately, the journey into Bitcoin mining in America is one of discovery and potential. With the right tools, knowledge, and timing, what starts as a curiosity can evolve into a thriving enterprise. As cryptocurrencies continue to reshape the financial world, the doors to lucrative opportunities remain wide open, inviting a new wave of pioneers to join the revolution.