The world of cryptocurrencies, once a niche interest, has surged into mainstream consciousness, reshaping our financial landscapes. In this rapidly evolving sector, 2025 promises to be a hallmark year, especially for companies engaged in selling mining machines and providing hosting services for those machines. As Bitcoin, Ethereum, and Dogecoin continue to dominate the market, understanding the nuances of this explosive growth is key for any entrepreneur or investor aiming to capitalize on mining’s immense potential.

Mining, the process of validating transactions on blockchain networks in exchange for cryptocurrencies, has become increasingly sophisticated. As technological advancements pivot toward energy efficiency and higher computational power, the demand for state-of-the-art mining rigs is soaring. Each miner hoping to stake their claim in this lucrative arena is searching for equipment that can deliver superior performance and faster returns on investment. This leads to a golden opportunity for firms specializing in mining machine sales to adapt their product offerings to the latest innovations.

Consequently, hosting services are flourishing. For many miners, the idea of maintaining equipment—often located in areas conducive to energy consumption and cooling—can be daunting. This is where hosting comes into play. Companies that provide secure, high-performance environments for mining operations are witnessing skyrocketing demand. They take care of the burdens that come with running mining rigs, allowing miners to focus on their core goal: maximizing profitability.

2025’s trends are pointing toward a refined approach to mining farms, where miners are increasingly seeking collaborative setups. These spaces, often designed under a single roof, facilitate the amalgamation of resources, risk-sharing, and collective innovation. Such environments are conducive to the exchange of ideas, ultimately enhancing operational efficiencies and diversifying the crypto assets being mined. This shift isn’t merely about cost-sharing but represents a cultural evolution within the mining community itself—a natural response to the challenges faced in the crypto economy.

Moreover, cryptocurrencies are on a tumultuous journey of transition. Bitcoin remains the gold standard, with its halving events periodically impacting the reward structure, thus influencing the market’s health. However, Ethereum’s new proof-of-stake protocol has opened doors for innovation, allowing other cryptocurrencies to compete. Understanding these dynamics will be crucial for companies looking to position their mining machines strategically. The key to thriving in 2025 will be adaptability, ensuring machines can cater to multiple currencies and their nuanced requirements.

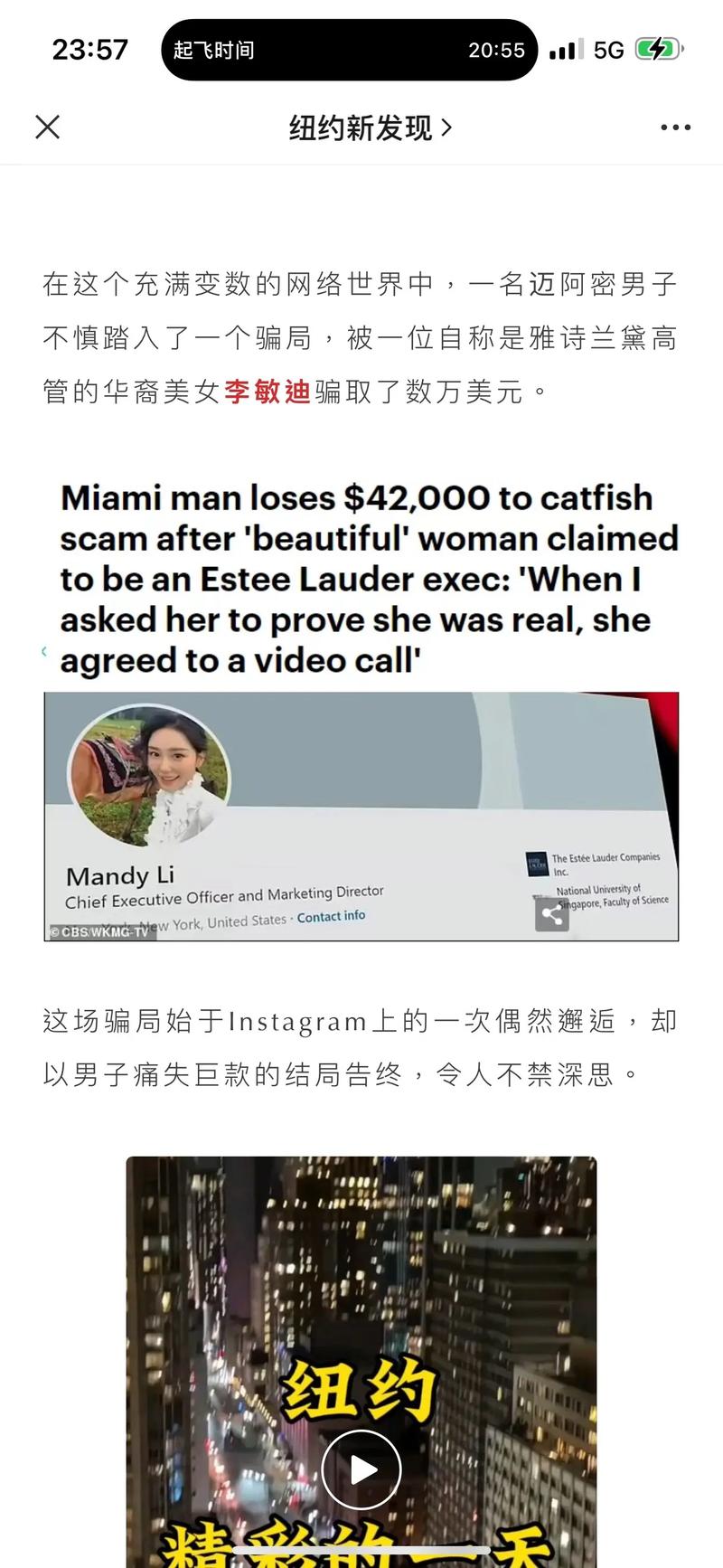

In the realm of exchanges, transparency and security are more crucial than ever. Miners and investors alike are becoming increasingly vigilant about where they stake their crypto assets. The rise in fraud and hacking incidents has spurred a clamor for decentralized and reputable platforms. As a result, forging partnerships with exchanges that prioritize security can become a pivotal aspect of a mining machine company’s strategy. A mining operation backed by a trusted exchange ensures smoother transactions and greater peace of mind for investors.

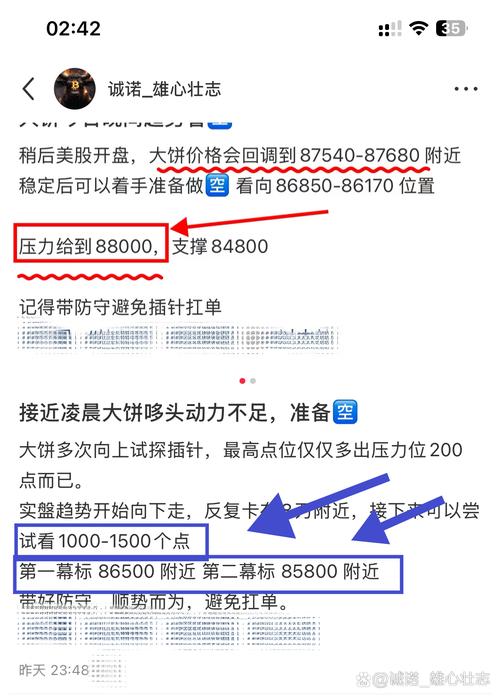

As the ecosystem surrounding cryptocurrencies grows, the importance of community cannot be overstated. Influencers, advocates, and everyday miners make up the backbone of the network, and fostering these connections can unlock new opportunities. Social media platforms have broadened the horizon for sharing knowledge and insights, as dialogues about rigs, hosting, and trends become fundamental to progress. Companies need to engage creatively with these communities to rise above the competition.

The intricacies of the market demand a multi-faceted approach. The need for diversification has never been more prominent, as AVAX, DOGE, and even innovative altcoins capture the attention of traders and miners. Mining machine companies should embrace a broad-spectrum strategy not just to maximize profits but to enhance stability by ensuring their equipment can support a range of cryptocurrencies. This diversification can be the buffer needed against market volatility—a necessary consideration for longevity in the mining equipment sector.

As we edge closer to 2025, the convergence of technology, community knowledge-sharing, and economic strategies will prove fundamental in revolutionizing the landscape of crypto mining. The companies that seize this momentum, pivoting their offerings to align with the emerging trends, will emerge as the leaders of tomorrow—transforming not just their businesses, but the entire crypto ecosystem.