The landscape of cryptocurrency mining is ever-evolving, and as we delve into 2025, potential miners and established operators alike are left grappling with one pivotal question: How can one maximize profitability? Understanding the mechanisms behind mining, coupled with strategic choices regarding mining machines and their hosting, is crucial for success. In this intricate world, a balance between investment and return often dictates whether a mining operation thrives or falters.

At its core, mining profitability hinges on several fundamental factors: the cost of energy, the efficiency of mining hardware, cryptocurrency market dynamics, and, importantly, the choice of which cryptocurrencies to mine. Bitcoin (BTC) continues to dominate the conversation, especially given its established trust and high market cap. However, alternative currencies like Dogecoin (DOGE) and Ethereum (ETH) present their own unique opportunities for miners willing to diversify their tactics. Understanding the computational requirements and market conditions of each currency is paramount.

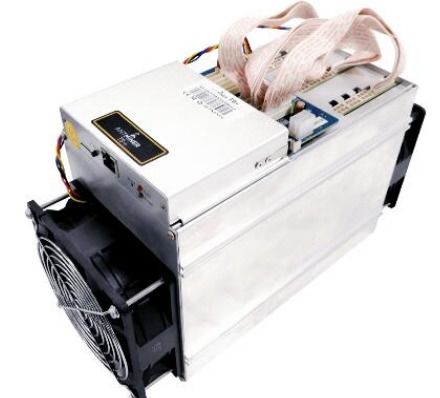

A significant element in boosting mining profitability lies in selecting the right mining rig. The technical specifications of hardware—hash rate, power consumption, and initial investment—are critical components. For BTC mining, ASIC miners are the gold standard, delivering unparalleled efficiency. Conversely, GPU rigs have garnered the spotlight in the ETH mining community, leveraging their versatility and adaptability to different mining algorithms. As miners evaluate their options, a clear grasp of which rigs align best with specific cryptocurrencies is essential.

Beyond mere hardware selection, hosting services are becoming increasingly relevant. Whether it’s a personal setup or leveraging a mining farm’s advantages, hosting solutions can directly influence profit margins. Hosting operations manage multiple rigs, ensuring optimal performance, cooling, and energy efficiency. This approach not only alleviates the complexities of operation but also allows miners to focus on broader strategies that increase their yields. When collaborating with a hosting service, miners should engage with their operational practices, curating a service that maximizes up-time and efficiency.

As one begins to consider profitability, one must also evaluate the impact of market trends on their chosen currencies. The volatility of cryptocurrencies is notorious, often leading to an uncertain financial landscape. This necessitates astute market analysis and timing, which can substantially alter profitability calculations. Additionally, factors such as transaction fees, block rewards, and fluctuations in mining difficulty levels should be constantly monitored. A well-designed trading strategy can complement mining activities, allowing individuals to capitalize on rising market tides.

In the age of technology, tools for forecasting and measuring mining profitability have flourished. Miners can access platforms that provide calculators, algorithms, and insights that leverage historical data. These utilities can predict returns based on real-time factors—energy costs, hardware performance, and expected cryptocurrency values. Such analytical tools are invaluable for the modern miner looking to make informed decisions and understand the nuances of their operations.

Moreover, education is a cornerstone of effective mining practices. A community-driven approach invites collaboration and knowledge sharing among miners—fostering innovation and progressive methodologies. From forums dedicated to tackling technical challenges to social media groups where miners exchange tips, the collective intelligence can pave the way for discovering strategies that bolster profitability.

As we venture further into 2025, the imperative of sustainability cannot be overlooked. The environmental concerns surrounding cryptocurrency mining have led to a quest for greener practices. This has resulted in some operations transitioning to renewable energy sources, which potentially reduces operational costs while appealing to the growing demographic of eco-conscious investors. By integrating sustainable methodologies, miners not only bolster their bottom line but also contribute positively to the broader conversation surrounding energy consumption in the crypto sector.

Ultimately, the quest for mining profitability in 2025 is a multi-faceted endeavor. By aligning hardware efficiency, market strategy, hosting solutions, and educational resources, miners can navigate the complex ecosystem of cryptocurrencies. With diligence and innovation, optimizing returns in this dynamic field remains not just attainable, but an exciting opportunity for those ready to explore its depths.

This article offers a deep dive into mining profitability, blending complex calculation methods with innovative strategies to amplify income. It covers market trends, cost optimization, and emerging technologies, providing miners with unpredictable yet practical insights to maximize financial gains in 2025.