The relentless march of technological innovation continues to reshape the landscape of cryptocurrency mining, particularly as we approach 2025. At the forefront of this evolution stands Canaan, a leading manufacturer of Application-Specific Integrated Circuit (ASIC) miners, and Bitcoin, the undisputed king of cryptocurrencies. Their relationship, a dynamic interplay of hardware prowess and digital asset dominance, forms the bedrock of optimized crypto mining strategies for the years ahead.

Bitcoin, conceived as a decentralized digital currency, relies on a network of miners to validate transactions and secure the blockchain. This validation process, known as mining, involves solving complex cryptographic puzzles, a task that demands immense computational power. Early Bitcoin mining was accessible to individuals with standard computer CPUs, but as the network grew and the puzzles became more intricate, the need for specialized hardware became apparent.

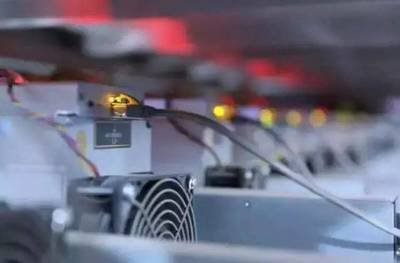

Enter ASICs. These chips, engineered specifically for the singular purpose of mining cryptocurrencies like Bitcoin, offer a far superior hash rate (the speed at which a miner can solve these puzzles) compared to CPUs and GPUs. Canaan, recognized for its Avalon series of ASIC miners, has consistently pushed the boundaries of hash rate efficiency and power consumption. Their miners are sought after by both individual miners and large-scale mining operations (mining farms) seeking a competitive edge.

The “synergistic approach” highlighted in the title alludes to the symbiotic relationship between Canaan’s ASIC technology and Bitcoin’s mining ecosystem. Canaan’s technological advancements directly benefit Bitcoin by providing miners with the tools to secure the network more efficiently and profitably. In turn, the demand for Bitcoin mining drives innovation and competition in the ASIC market, incentivizing companies like Canaan to develop even more powerful and efficient miners. This virtuous cycle is crucial for the long-term health and stability of the Bitcoin network.

Looking ahead to 2025, several factors will influence the optimization of crypto mining strategies. The Bitcoin halving events, which occur approximately every four years, reduce the block reward given to miners, increasing competition and necessitating greater efficiency. Energy costs, another significant factor, continue to fluctuate, making energy-efficient miners like those produced by Canaan even more valuable. Furthermore, the growing awareness of the environmental impact of crypto mining is pushing the industry towards more sustainable practices, such as utilizing renewable energy sources and optimizing mining infrastructure.

Canaan and other ASIC manufacturers are actively responding to these challenges by developing miners that are not only more powerful but also more energy-efficient. Innovations in chip design, cooling systems, and power management are constantly being implemented to reduce operating costs and minimize environmental impact. The rise of immersion cooling, for example, is enabling higher hash rates and greater energy efficiency by submerging the miners in a dielectric fluid.

Mining machine hosting, another crucial aspect of the crypto mining landscape, is evolving rapidly. Companies specializing in hosting services provide miners with the infrastructure, power, and cooling necessary to operate their equipment. These facilities often offer advantages such as lower electricity rates and optimized network connectivity. Selecting a reliable and efficient hosting provider is essential for maximizing profitability and minimizing downtime.

Beyond Bitcoin, ASIC technology is also being applied to the mining of other cryptocurrencies, although Bitcoin remains the dominant focus. Ethereum, before its transition to Proof-of-Stake, was heavily reliant on GPU mining, but ASICs designed for Ethereum mining did emerge. Dogecoin, while initially resistant to ASIC mining, eventually saw the development of specialized hardware to mine it more efficiently. The profitability of mining different cryptocurrencies depends on factors such as the coin’s price, the difficulty of the mining algorithm, and the energy efficiency of the mining hardware.

The world of cryptocurrency exchanges also plays a vital role in the mining ecosystem. Miners often sell their mined coins on exchanges to cover operational costs and generate profits. The liquidity and trading volume of an exchange can directly impact a miner’s ability to convert their mined coins into fiat currency or other cryptocurrencies. Furthermore, the regulatory landscape surrounding exchanges is constantly evolving, adding another layer of complexity to the mining business.

In conclusion, the relationship between Canaan’s ASIC technology and Bitcoin mining represents a powerful synergy that is shaping the future of the cryptocurrency industry. As we move closer to 2025, the optimization of mining strategies will require a keen understanding of technological advancements, energy efficiency, regulatory developments, and market dynamics. Miners who can effectively leverage these factors will be best positioned to thrive in the increasingly competitive world of crypto mining. The focus on efficient, powerful hardware coupled with strategic operational decisions will define success in the evolving landscape of Bitcoin and beyond.

Canaan innovates mining! This analysis projects 2025 optimization via their ASICs, highlighting efficiency gains. A promising, yet potentially volatile, synergistic future. Watch for market dominance shifts!