In the ever-evolving landscape of digital currencies, crypto mining machines stand as the unsung heroes, powering the networks that underpin Bitcoin, Ethereum, and a myriad of other cryptocurrencies. As we dive into 2023, the United States emerges as a hotspot for lucrative deals on these essential tools. Imagine harnessing the raw power of a state-of-the-art mining rig, tucked away in a professional hosting facility, turning electricity into potential fortune. This article unravels the must-have mining machines available in the USA, blending cutting-edge technology with savvy investment strategies to help you navigate this thrilling domain.

At the heart of cryptocurrency mining lies Bitcoin, or BTC, the pioneer that sparked a global revolution. For enthusiasts eyeing BTC mining, machines like the Antminer S19 series dominate the scene with their unparalleled hash rates and energy efficiency. These beasts can churn out hashes at speeds exceeding 100 terahashes per second, making them indispensable for serious miners. Yet, it’s not just about raw power; consider the hosting options that allow you to sidestep the hassles of setup and maintenance. In the USA, facilities in states like Texas and Washington offer secure, climate-controlled environments where your mining machine can operate optimally, often with access to cheap electricity deals that boost profitability. Diversifying beyond BTC, miners are also flocking to altcoins like Dogecoin (DOG), which, despite its meme origins, demands robust hardware for proof-of-work algorithms. A versatile machine, such as the Whatsminer M30S++, could handle DOG mining with ease, adapting to its Scrypt-based requirements while keeping an eye on the broader market volatility.

Transitioning to Ethereum, or ETH, the narrative shifts slightly with its impending move to proof-of-stake, yet mining remains relevant for those holding onto older hardware. ETH mining rigs, equipped with high-end GPUs like NVIDIA’s CMP series, offer a gateway to not just Ethereum but also other GPU-friendly coins. The USA market in 2023 is ripe with deals, from bundled packages that include hosting services to standalone sales that cater to DIY enthusiasts. Picture this: a custom-built mining farm buzzing with activity, where multiple rigs synchronize to maximize output, all while exchanges like Coinbase and Binance provide seamless ways to trade your mined ETH. The burst of innovation in this space ensures that no two setups are alike, with some opting for cloud mining as a low-entry alternative.

Now, let’s talk mining farms—the colossal operations that house hundreds of machines in synchronized harmony.

These facilities, often located in the USA’s energy-rich regions, provide the infrastructure for hosting your mining machines, allowing individuals and businesses to scale without the overhead. For instance, partnering with a hosting provider means you can focus on strategy while they handle the technicalities, from cooling systems to network security. This setup is particularly advantageous for newcomers to the crypto world, offering a blend of accessibility and professional oversight.

Diving deeper into the specifics, a miner’s choice often boils down to the type of rig they select. A mining rig, essentially a customized computer optimized for crypto mining, can range from simple, single-GPU setups for ETH to elaborate, ASIC-based monsters for BTC. In 2023’s USA deals, brands like Bitmain and Canaan are slashing prices on their latest models, making it an opportune time to invest. The unpredictability of the market adds a layer of excitement; one day you’re mining DOG for fun, the next you’re capitalizing on a BTC surge. Exchanges play a pivotal role here, facilitating the conversion of mined coins into fiat or other assets, ensuring liquidity in an otherwise volatile ecosystem. With rich vocabulary at our disposal, think of these rigs not just as hardware, but as gateways to digital gold rushes, each circuit board a ticket to potential wealth.

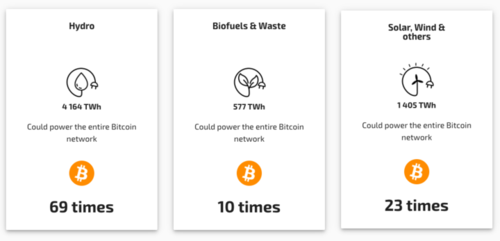

As we explore these deals, it’s crucial to consider the environmental impact and sustainability efforts. Many USA-based providers are adopting green energy solutions, aligning mining operations with renewable sources to mitigate carbon footprints. This not only appeals to eco-conscious miners but also enhances long-term viability. For those venturing into DOG or ETH, the community aspect shines through forums and online exchanges, where tips on optimizing rigs for maximum efficiency are shared freely. The rhythm of this industry pulses with innovation, from software updates that fine-tune algorithms to hardware advancements that push boundaries, creating a tapestry of opportunities that’s as diverse as the cryptocurrencies themselves.

In wrapping up, the must-have crypto mining machines of 2023 in the USA represent more than just tools; they embody a fusion of technology, strategy, and foresight. Whether you’re drawn to the stability of BTC, the community vibe of DOG, or the smart contract capabilities of ETH, there’s a machine and a deal waiting to elevate your mining game. From selecting the right miner to leveraging hosting services, the path to success is layered with choices that demand both passion and prudence. As deals abound, seize the moment to build your empire, one hash at a time, in this exhilarating world of digital currencies.