In the rapidly evolving landscape of cryptocurrencies, choosing the optimal hardware for Bitcoin mining is a critical decision that can determine your venture’s success or failure. The relentless pursuit of efficiency, power, and profitability transforms the selection process into a complex ballet of technical specifications and market dynamics. Bitcoin mining hardware isn’t merely about raw speed; it’s also a symphony of energy consumption, cooling requirements, and integration with hosting services that amplify mining operations without escalating costs.

First and foremost, understanding the core principles behind Bitcoin mining technology empowers miners to make informed choices. At its heart, Bitcoin mining involves solving complex cryptographic puzzles to validate transactions and add blocks to the blockchain, rewarding the miner with freshly minted bitcoins. This process demands intensive computational power, typically delivered through specialized devices called ASIC miners — Application-Specific Integrated Circuits — designed exclusively for Bitcoin’s SHA-256 algorithm. Unlike general-purpose GPUs commonly used in ETH or DOGE mining, ASIC miners relegate performance efficiency to an entirely different stratum.

While selecting a mining rig, it’s tempting to focus solely on hash rate, expressed in terahashes per second (TH/s), but a holistic evaluation requires looking beyond speed. Power consumption — often measured in watts — directly impacts profitability margins since electricity constitutes one of the most significant recurring expenses in mining farms. Pairing a high hash rate with excessive energy use can neutralize any perceived advantage. Therefore, the hash rate-to-watt ratio becomes a fundamental metric for assessing efficiency, guiding miners towards models that maximize output per unit of energy.

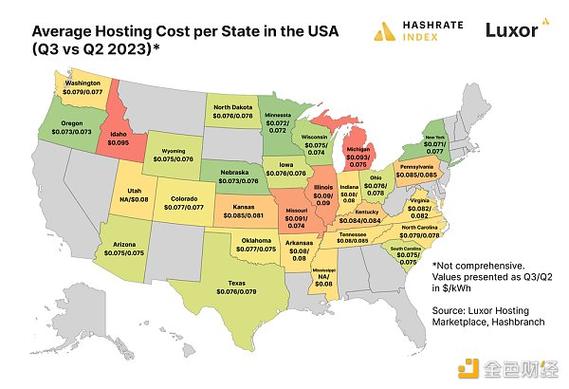

Mining machine hosting services introduce an additional layer of convenience and scalability. These facilities provide the necessary infrastructure: optimized electrical systems, climate-controlled environments, and physical security. For emerging miners without the resources or expertise to build their own operations, hosting offers access to professional-grade setups, often bundled with maintenance and monitoring tools. This service effectively accelerates the mining journey by alleviating operational burdens and reducing downtime, a crucial factor given Bitcoin’s volatile price shifts.

The cryptocurrency ecosystem’s diversity also raises intriguing questions about hardware interoperability. While ASIC miners dominate Bitcoin mining, the hardware choices for cryptocurrencies such as Ethereum and Dogecoin differ significantly. Ethereum mining predominantly relies on GPU rigs, favoring versatile graphics cards with parallel processing prowess. Dogecoin mining, closely related to Litecoin due to its Scrypt algorithm, sometimes leverages ASICs but at a different scale and architecture compared to Bitcoin mining devices. Consequently, enterprises with diversified mining portfolios must tailor hardware investments carefully, balancing the specialized needs of BTC rigs against the adaptable power of GPU rigs to optimize multi-coin profitability.

Another compelling facet is the rise of mining farms — sprawling facilities housing thousands of miners, sometimes extending to megawatt-scale operations. These farms harness economies of scale: bulk hardware purchases reduce individual unit costs, while advanced cooling designs mitigate thermal risks. Mining farms operate as the backbone of the Bitcoin network’s security and decentralization, yet their prosperity hinges on meticulous hardware selection and maintenance strategies. The choice between older but proven miners versus next-generation ASIC devices often depends on upfront capital, available energy prices, and anticipated network difficulty adjustments.

Navigating the complex marketplaces of cryptocurrency exchanges provides another insight into the demand and valuation trends influencing hardware selection. Marketplaces dictate Bitcoin’s price volatility and substantially affect mining profitability. Sharp increases in BTC prices can justify investing in state-of-the-art miners, while downturns might incentivize cost-cutting and hardware repurposing. Savvy miners monitor exchange trends alongside mining difficulty to strategically time equipment upgrades or divestments.

Ultimately, selecting the best Bitcoin mining hardware is not a static decision but a dynamic process that unfolds in tandem with technological advances and market fluctuations. Successful miners implement comprehensive research protocols — analyzing miner reviews, manufacturer reputations, firmware stability, and integration potential with hosting solutions. They also consider community feedback within forums and follow regulatory developments affecting energy consumption and cryptocurrency legality.

To thrive in the Bitcoin mining domain, embracing flexibility and scalability is vital. Whether deploying a single ASIC miner in a home setup or orchestrating a vast mining farm, every hardware choice shapes operational efficiency and long-term viability. As blockchain technology continues to revolutionize financial systems globally, the miner who decodes the subtle interplay between hardware capabilities, energy optimization, and market dynamics will secure a formidable position in this electrifying digital frontier.

Unveiling Bitcoin mining’s hidden gems, this guide cleverly decodes hardware choices with surprising twists on energy efficiency, cooling innovations, and cost hacks, empowering miners to outsmart the competition in an unpredictable crypto world!