In an ever-evolving digital economy, the role of cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG) has become pivotal, driving significant transformations in financial paradigms and technological infrastructure. Central to this revolution are mining machines—specialized hardware designed to solve complex cryptographic challenges necessary for validating transactions and adding new blocks to the blockchain. Particularly in Asia, where mining operations have grown exponentially, the regulatory landscape profoundly influences the security paradigms surrounding mining machine hosting and the broader crypto ecosystem.

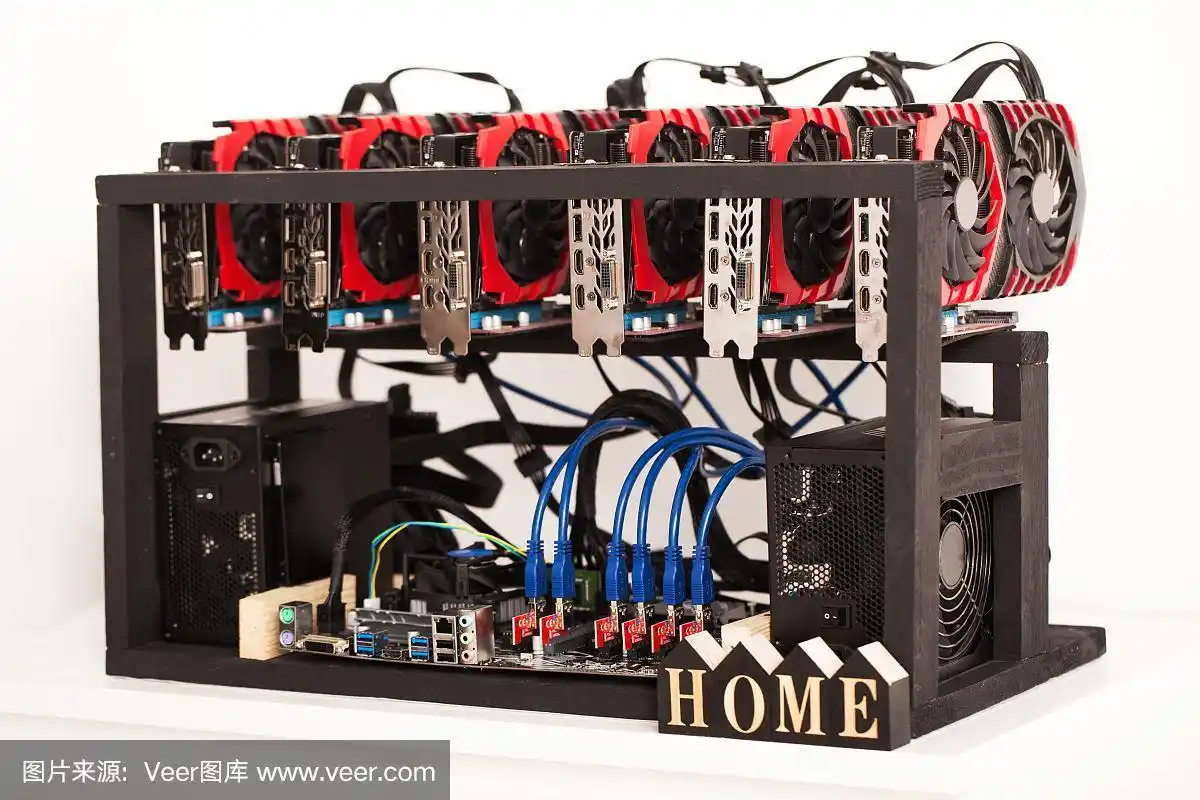

The backbone of crypto mining lies within the mining rig, a meticulously configured assembly of high-performance computational units optimized for hashing power. These rigs consume considerable energy and require robust cooling and environmental controls, factors that have led many operators to adopt mining farm hosting solutions. Hosting farms provide secure, scalable environments where miners can lease space, ensuring optimal operation conditions without managing fluctuating costs of electricity and equipment maintenance. However, in regions like Asia, where governments have introduced stringent policy frameworks aimed at controlling energy consumption and financial risks, the implications for mining hosting security are multifaceted.

Regulatory bodies in countries like China, South Korea, and Singapore exhibit diverse approaches—from outright bans and severe restrictions to fostering crypto innovation via sandbox regulations. For example, China’s sweeping ban on crypto mining catalyzed a massive migration of mining operations to neighboring countries such as Kazakhstan and Vietnam. This relocation not only forced mining farms to upgrade their security protocols to counteract potential vulnerabilities during the transition but also raised concerns surrounding the physical security of hosting sites and cybersecurity threats. Hosting providers had to reinforce perimeter defenses, install advanced intrusion detection systems, and implement multi-layered authentication methods to ensure that miners’ assets—both physical rigs and cryptographic keys—remain impervious to theft and sabotage.

Bitcoin miners face particular challenges in this regulatory milieu. The decentralized ethos of BTC contrasts with the centralized constraints imposed by national regulations, leading to a paradox where miners strive to maximize decentralization benefits while complying with local laws. This tension results in a heightened focus on securing mining rigs against illicit access and ensuring compliance without compromising operational efficiency. Electronic exchanges have also become tightly interwoven with mining ecosystems, necessitating protocols that verify the provenance of mined coins to prevent money laundering—a regulatory stipulation increasingly emphasized by Asian financial authorities.

Ethereum miners, on the other hand, navigate a slightly different landscape. With ETH’s ongoing shift to proof-of-stake and reduced reliance on traditional mining rigs, hosting providers must innovate to accommodate diversifying hardware and software demands. However, for those still engaged in Ethereum proof-of-work mining, the hosting security framework in Asia adapts to regulatory shifts that emphasize transparency and environmental impact disclosures. This pressure has led to the adoption of green energy solutions in mining farms, integrating solar and hydroelectric power with enhanced monitoring systems governed by blockchain-based audit trails. These advancements not only ensure regulatory compliance but also elevate the security fabric by providing immutable records of power usage and equipment status.

Dogecoin miners and enthusiasts, though often overshadowed by Bitcoin and Ethereum, contribute to the intricate web of mining activities dispersed throughout Asia. Given DOG’s origins as a meme coin and its lightweight blockchain, mining rigs dedicated to this currency require less power but face unique security challenges, particularly from opportunistic cyber threats seeking to exploit lower-security hosting environments. Consequently, hosting operators have adopted adaptive security measures tailored to the scale and scope of the mining rig’s contribution to network integrity, balancing cost and protection efficacies.

The cross-pollination among cryptocurrencies, mining hardware development, hosting ecosystems, and regulatory frameworks within Asia creates a dynamic environment where security is paramount. Miners must remain vigilant against emerging threats—ranging from physical breaches and cold wallet hacking to supply chain attacks targeting firmware embedded in mining machines. Exchanges, acting as bridges between miners and the global financial system, reinforce security protocols to protect wallets, transactional data, and communication channels, integrating know-your-customer (KYC) and anti-money laundering (AML) frameworks stipulated by regulators.

Furthermore, the rise of decentralized exchanges and layer-2 scaling solutions introduces nuanced regulatory challenges for mining hosting services. The opacity and borderless nature of these solutions often clash with jurisdictional mandates, compelling hosting firms to employ innovative cybersecurity practices and maintain transparent disclosures to regulators. Asian governments continue to refine their approaches, sometimes incentivizing green mining initiatives or mandating rigorous reporting standards. This policy flux requires operators to design flexible, scalable security architectures that adapt to evolving compliance requirements without hindering miner profitability and technological advancement.

In conclusion, the impact of regulations on Asian mining hosting security is profound and multifaceted. As mining machines and mining rigs become increasingly sophisticated and integral to validating blockchains for BTC, ETH, DOG, and other cryptocurrencies, the hosting environments must evolve concurrently. Compliance-driven security measures now encompass physical infrastructure fortifications, cutting-edge cybersecurity defenses, environmental sustainability integrations, and meticulous operational transparency. For miners and hosting providers alike, navigating the labyrinth of regulatory expectations while maintaining operational security demands vigilance, adaptability, and innovative thinking—a symbiotic dance shaping the future of crypto mining in Asia and beyond.

A vital probe into regulatory impacts. Security? Think geopolitical chess, not just physical guards. Regulations reshape Asian mining’s risk landscape, with surprising winners and losers.