As the digital currency landscape continues to evolve, Litecoin mining remains a compelling venture for investors and tech enthusiasts alike. The United States, with its vast infrastructure, favorable regulatory environment, and robust technological advancements, has become an increasingly attractive hub for mining operations. For companies specializing in selling mining machines and providing hosting services, understanding the nuances of Litecoin mining and the investment potential in USA hardware is paramount. Litecoin, often dubbed the silver to Bitcoin’s gold, operates on a scrypt-based algorithm that requires specialized mining rigs distinct from those used in Bitcoin mining. This divergence in technology opens unique opportunities for mining farms and hardware suppliers to cater specifically to Litecoin miners seeking efficiency and profitability.

When considering the hardware aspect of Litecoin mining, it’s essential to recognize the critical role of ASIC miners designed explicitly for scrypt algorithms. Unlike CPU or GPU mining, which has largely been supplanted due to inefficiency, ASICs provide a focused and energy-efficient solution. In the USA, the accessibility of cutting-edge mining hardware combined with the nation’s relatively low electricity costs in some regions—such as Texas and Wyoming—creates a fertile ground for mining operations. In this context, hosting services gain prominence, offering miners not just the procurement of equipment but also the management of power consumption, cooling solutions, and maintenance. These services reduce the operational burdens on investors, enabling them to leverage the benefits of mining without deep technical involvement.

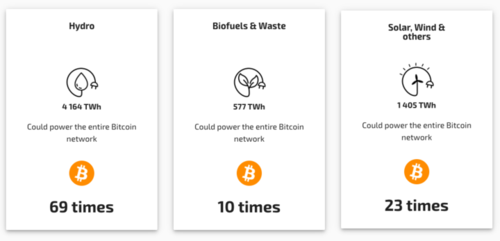

Moreover, emerging trends in renewable energy adoption within the USA provide a crucial dimension to mining investments. Environmental sustainability, once a marginal concern, has surged to the forefront, prompting mining farms to incorporate solar, wind, and hydroelectric sources. This integration not only reduces costs but also curtails the ecological footprint of Litecoin mining operations. For businesses specializing in mining machine hosting, integrating renewable energy solutions translates into compelling value propositions for clients, potentially scaling up the attractiveness of their services. This interplay between hardware efficiency and energy innovation represents an evolving frontier in Litecoin mining economics.

Investors must also take note of the fluctuating dynamics within the cryptocurrency market, particularly how Litecoin’s price volatility impacts mining profitability. Given Litecoin’s design for faster transaction confirmations and lower fees relative to Bitcoin and Ethereum, its mining ecosystem tends to attract a diverse array of participants—from individual enthusiasts with small rigs to large-scale mining farms. The synchronization between mining difficulty adjustments and market price fluctuations demands a nimble approach to investment strategies. Hosting platforms supporting Litecoin miners often deploy analytics to predict optimal mining periods, enabling clients to maximize returns through dynamic hardware allocation and adjusting mining intensity based on real-time metrics.

The geographical advantages the USA offers are supplemented by robust network connectivity and hardware innovation cycles. Manufacturers of Litecoin mining rigs continue to push the envelope, developing machines with enhanced hash rates and energy efficiency. For companies in the mining machine sales sector, staying abreast of these technological advancements and maintaining a diverse inventory is crucial. This approach provides clients with a spectrum of options catering to both entry-level miners and seasoned operators aiming to optimize yield. Furthermore, hosting providers often bundle these machines with comprehensive service packages, including setup, continuous monitoring, and firmware updates, ensuring that the hardware’s performance remains at peak levels throughout its operational lifespan.

To concretize the investment potential, consider a Litecoin mining farm strategically situated in a region of the USA with surplus renewable energy infrastructure. Here, miners deploy state-of-the-art ASIC rigs coupled with intelligent hosting solutions that balance power consumption and ambient temperature through advanced cooling technologies. The result is a maximized hash rate decoded from each watt consumed, translating to improved margins and faster return on investment. Such operations embody the symbiotic relationship between hardware advancement, mining efficiency, and sustainable practices—a model likely to dominate the future landscape of Litecoin mining.

In summation, investing in Litecoin mining hardware within the USA presents a multifaceted opportunity enriched by technological innovation, supportive infrastructure, and evolving energy paradigms. Companies selling specialized mining machines and offering hosting services stand at an advantageous intersection, poised to empower a growing segment of miners seeking reliable, efficient, and sustainable solutions. As the mining ecosystem matures, synergy among investors, machine suppliers, and hosting providers will be integral to harnessing Litecoin’s full potential, not merely as a cryptocurrency but as a dynamic component of the broader blockchain economy.

Exploring Litecoin mining’s future reveals dynamic shifts as US hardware investments promise enhanced efficiency, sustainability challenges, and potential regulatory impacts, shaping both economic opportunities and technological innovations in the evolving crypto landscape.